Understanding Financial Abuse

Understanding Financial Abuse: A Hidden Form of Control in Abusive Relationships

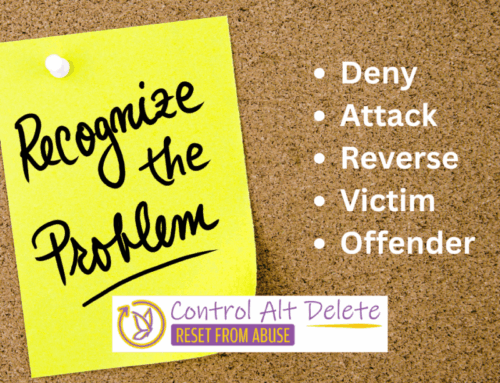

When we think of domestic abuse, the first images that come to mind often involve physical or emotional harm. However, there is another insidious form of abuse that is often overlooked—financial abuse. This type of abuse can be just as damaging as physical or emotional abuse, trapping Survivors in a cycle of control and dependency that is difficult to escape.

What is Financial Abuse?

Financial abuse occurs when one partner uses money and financial resources to exert control over the other. This can take many forms, from controlling all the household income and expenses to sabotaging the Survivor’s efforts to work or pursue education. The goal is to make the Survivor financially dependent, limiting their ability to leave the relationship or even make independent decisions.

Extravagant Purchases and Financial Manipulation

One common tactic used by abusers is to make extravagant purchases, such as luxury vehicles, but have the loans and financial obligations placed in the Survivor’s name. Here’s how this typically works:

- Manipulation and Coercion: The abuser may pressure or manipulate the Survivor into agreeing to take out loans or sign financial documents under the guise of love, trust, or shared responsibility. They might say, “This will help us build our future together,” or “It’s better for you to take the loan because of your good credit.”

- Isolation and Control: Once the loan is in the Survivor’s name, the abuser gains a powerful tool for control. They can threaten to default on payments, damaging the Survivor’s credit score, or even use the debt as a reason the Survivor “can’t” leave the relationship. The abuser may also isolate the Survivor by limiting their access to bank accounts, credit cards, and financial information.

- Long-Term Consequences: The financial strain of paying off loans for extravagant items like cars, boats, or expensive electronics can leave Survivors in a precarious financial situation. If they try to leave the relationship, they may be burdened with debt that wasn’t truly theirs, making it harder to start fresh.

Accruing Debt in the Survivor’s Name

Another devastating tactic of financial abuse involves the abuser accruing debt in the Survivor’s name without their full knowledge or consent. This can include taking out second and third mortgages on the home, opening credit cards, or securing loans—all in the Survivor’s name.

- Mortgages and Loans: Abusers may take out additional mortgages or loans, using the home as collateral, often without the Survivor’s knowledge. They may forge signatures or coerce the Survivor into signing under duress. When the Survivor finally escapes, they are often shocked to discover the extent of the debt tied to their name, which can include multiple mortgages that have drained the equity from their home.

- Credit Cards: Abusers might open credit cards in the Survivor’s name and rack up significant debt, all while hiding the bills or statements. When the Survivor leaves, they may be hit with the reality of maxed-out credit cards and overwhelming debt that they had no hand in creating.

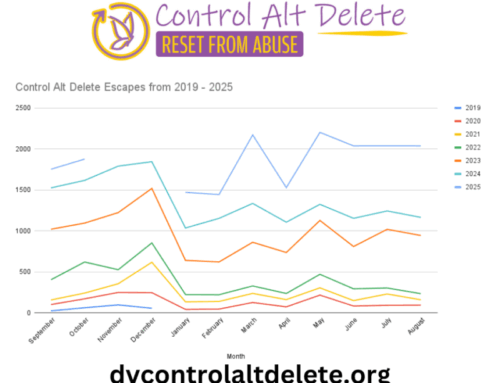

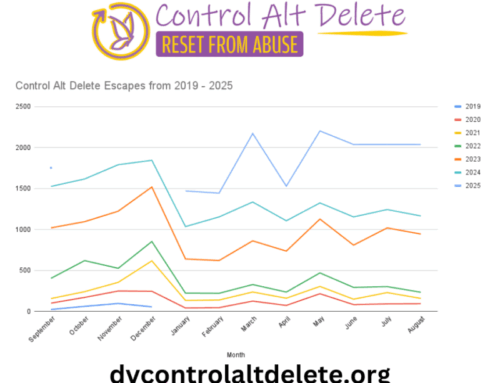

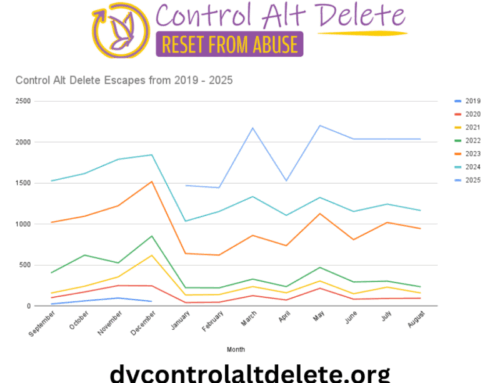

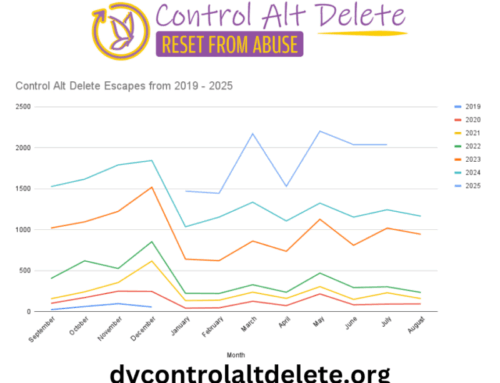

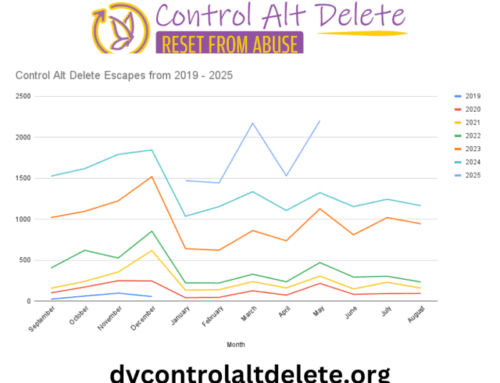

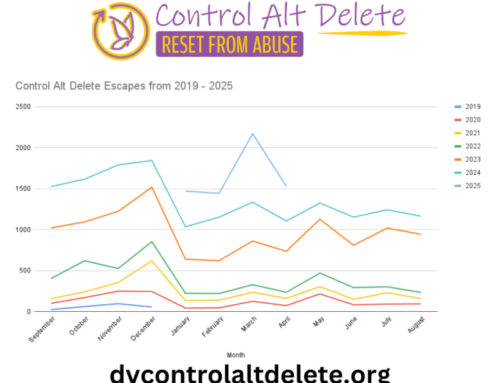

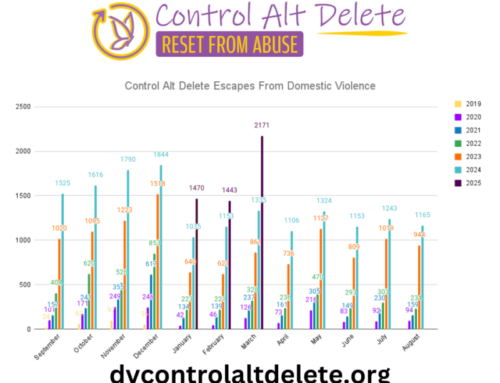

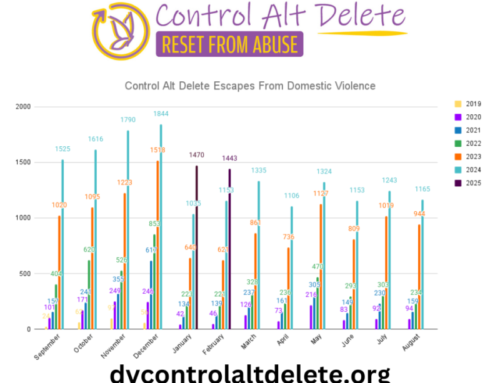

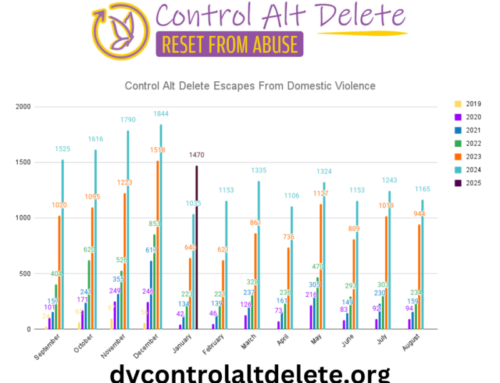

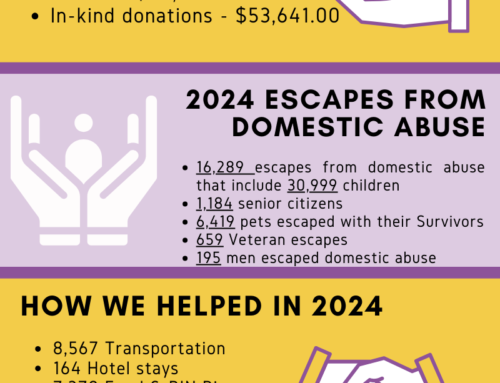

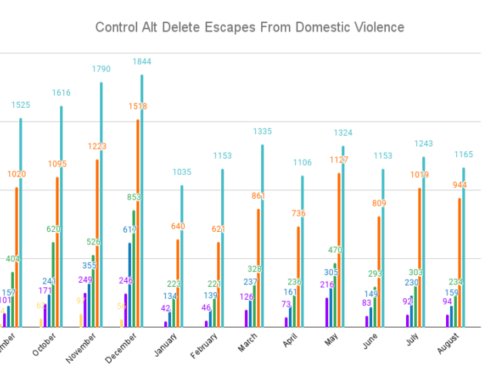

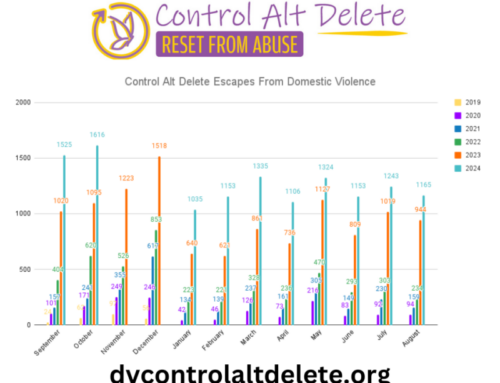

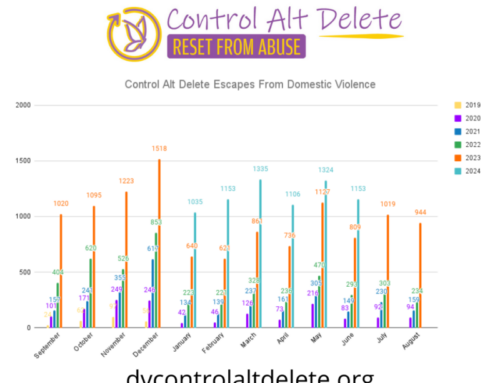

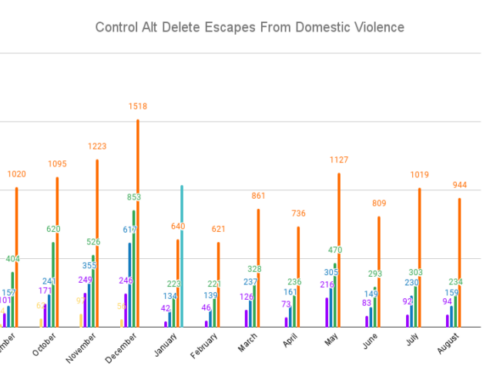

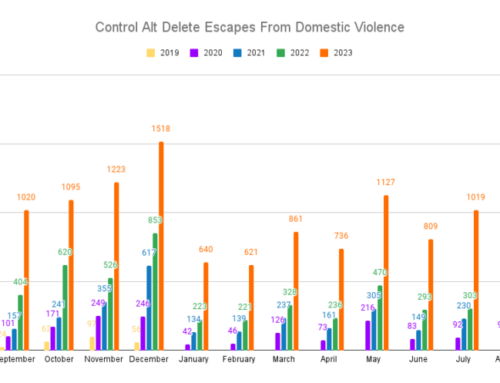

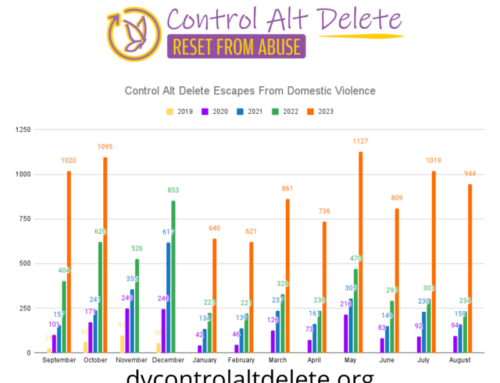

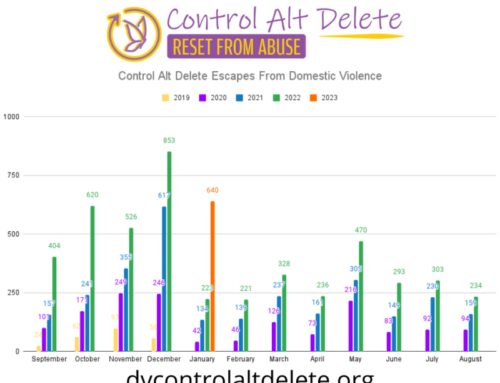

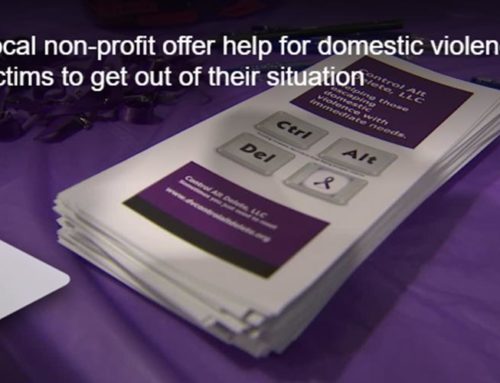

The Widespread Impact: 98% of Control Alt Delete Escapes Involve Financial Abuse

At Control Alt Delete, we have seen firsthand how pervasive financial abuse is in abusive relationships. A staggering 98% of the Survivors we assist in their escapes have been financially abused. This statistic highlights just how widespread this form of control is—and how crucial it is to recognize and address it.

The Impact on Credit and Housing

One of the most damaging aspects of financial abuse is how it can ruin a Survivor’s credit. When abusers take out loans, open credit cards, or secure mortgages in the Survivor’s name and then fail to make payments, it leaves the Survivor with a damaged credit score. This can have severe consequences, especially when the Survivor decides to escape.

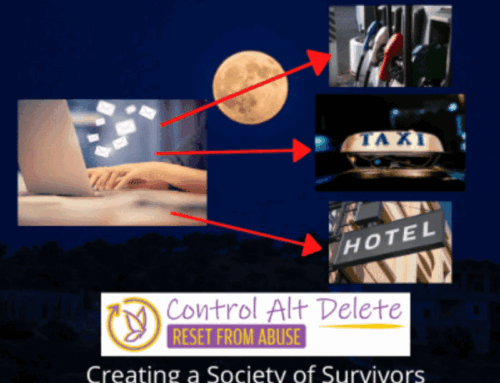

Securing Housing: A poor credit score can make it extremely difficult for Survivors to secure housing when they decide to leave an abusive relationship. Many landlords run credit checks as part of the rental application process, and a low credit score can lead to rejection. Even if a Survivor can find housing, they may face higher security deposits or less favorable lease terms.

Starting Fresh: Beyond housing, bad credit can impact a Survivor’s ability to open a bank account, get a credit card, or even secure a job in some cases. This financial instability adds another layer of challenge to rebuilding their life after escaping abuse.

Breaking Free from Financial Abuse

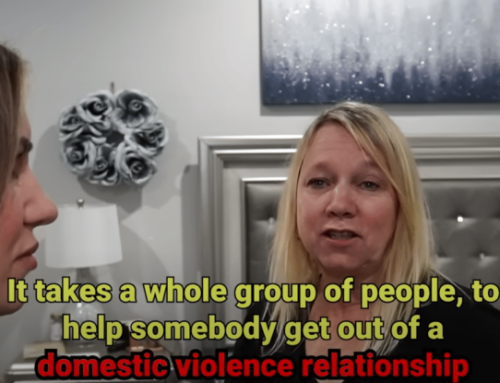

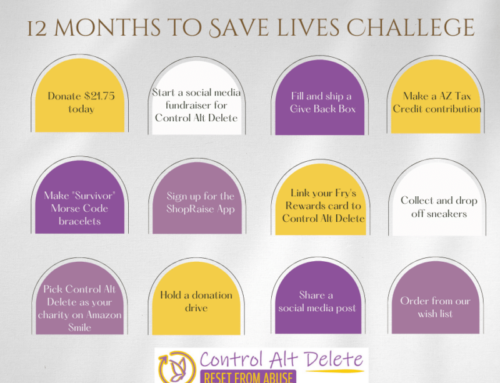

If you or someone you know is experiencing financial abuse, it’s important to know that there are resources available to help. Organizations like Control Alt Delete can provide immediate crisis assistance and help Survivors escape with a referral from a victim advocate, the prosecutor office or crisis response team such as police and fire departments.

Remember: Financial abuse is never the Survivor’s fault. It is a deliberate tactic used by abusers to maintain control. By recognizing the signs of financial abuse, we can take steps to protect ourselves and support others who may be in this situation.

If you’re ready to take that step, reach out to trusted organizations or financial advisors who specialize in helping Survivors. Every step toward financial independence is a step toward reclaiming your life.